philadelphia transfer tax exemption

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term lease or other writing. Provide the name of the decedent and estate file number in the space provided.

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Subsidies such as property tax abatements exemptions and reductions help businesses minimize the cost of owning real and business personal property by cutting or eliminating the taxes that they must pay on such property.

. Eration to a trust is exempt from tax when the transfer of the same property would be exempt from tax if the transfer. Philadelphia transfer tax part ii. The provisions of this Chapter 91 adopted May 10 1967.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. PdfFiller allows users to edit sign fill and share all type of documents online. Eration to a trust is exempt from tax when the transfer of the same property would be exempt from tax if the transfer.

The Council of the City of Philadelphia finds that. This link will take you to a sales tax table with an 800. Unfortunately the exemption for certain parties does not benefit the everyday real estate developer or homebuyer.

Some real estate transfers are exempt from realty transfer tax including certain transfers among family. 1092 unless otherwise noted. The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia.

Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes across on the day-to-day. And The Realty Transfer Tax Act 72 P. The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia.

266 to a delaware limited partnership the transaction will give rise to philadelphia realty transfer tax. Realty transfer tax service city of philadelphia. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

1 days ago effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a. It is important to know when you may be eligible for one of the many transfer tax exemptions. 2 hours ago the current rates for the realty transfer tax are.

Step 2 identify the sale price of the houseThe following steps provide information about how the transfer tax is calculated. The tax is prorated in accordance with the percentage of interest being transferred. Succession laws is exempt from tax.

How much is transfer tax in philadelphia. 32833292 unless otherwise noted. Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes across on the day-to.

Think of the transfer tax or tax stamp as a sales tax on real estate. Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. Philadelphia transfer tax law excludes 28 transactions while.

2 Under Federal State and City laws corporations and associations are entities separate from their members. For comparison Montgomery County Pennsylvanias transfer tax is only 1. The transfer tax in Philadelphia is 3 and on transfers for nominal consideration the tax is based upon the Fair Market Value of the property.

Contact our office to learn more at 267-423-4130. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. 25 A transfer to or from an organization which possesses a tax exempt status pursuant to Section 501c3 of the Internal Revenue Code of 1986 and which has as its primary purpose.

Attach a copy of the. 1 There are business economic and tax reasons for entities holding real estate to do business as corporations or associations. The parties to any such a transfer shall jointly sign the Philadelphia Real Estate Transfer Tax Certification Affidavit as issued by the Revenue Department.

For 2022 the increased transfer tax exemptions are as follows. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. One of the most popular transfer tax exemptions is the intra.

This exemption also applies to adding a Financially Interdependent Person to your Deed. Pennsylvania charges a 1 percent transfer tax on the value of the property being transferred. Below are a few of the more notable exemptions.

The State of Pennsylvania charges 1 of the sales price and the municipality and school district USUALLY charge 1 between them for a total of 2 ie. A husband and a wife even if parties are now divorced as long. The following transfers are excluded from the tax.

Both Philadelphia and Pennsylvania exclude parties such as the federal and state government as well as an instrumentality agency or governmental body of either. In 2020 youll see that the land is valued at 30315 and the improvements at 171785. This property is exempt from any relevant local or special taxations.

Our offices can work with you to determine if your real estate transaction may qualify and can help you take the necessary steps to create and record your deed and claim the exemption. However in Philadelphia. Transfer To or From Agent or Straw Party - A transfer to or from an agent is exempt from tax if a transfer to or from the agents principal by the third party would be exempt from tax.

The following transfers are excluded from the tax. How is Philadelphia transfer tax calculated. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

Amended through March 26 1971 effective March 27 1971 1 PaB. These documents contain the full regulations for the Realty Transfer Tax as well as clarifications from technical staff on how the Department of Revenue interprets the law. 2 X 100000 2000.

Pennsylvania Code section 91193 b 6 is all. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Real Estate Transfer Tax Montgomery County Local Law Firm

Owe Property Tax Get Into An Oopa To Stay Current Department Of Revenue City Of Philadelphia

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

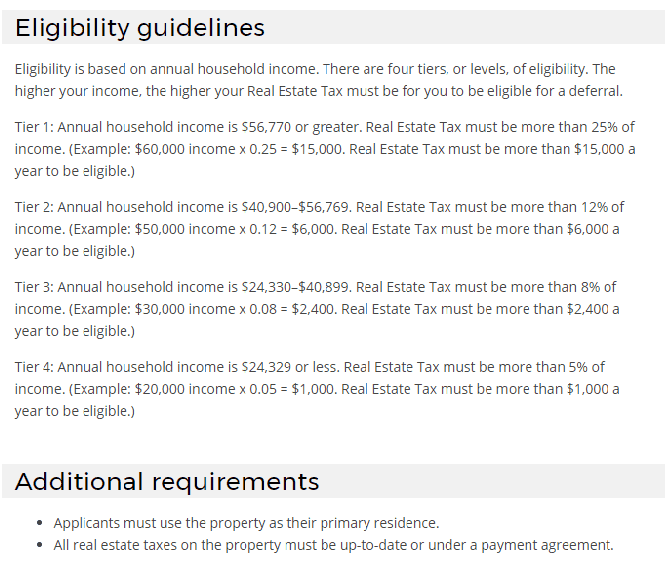

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Pdf The Effects Of Land Transfer Taxes On Real Estate Markets Evidence From A Natural Experiment In Toronto

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

Estate Tax Exemption Will Fall Now Is The Time To Plan Rea Cpa

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Three Different Routes To Save Tax On Long Term Capital Gains Ltcg Just Like You Pay Tax On Income Earned Selling Y Capital Assets Capital Gain Share Market

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

Philadelphia Transfer Tax Form Fill Online Printable Fillable Blank Pdffiller

Philadelphia Homeowners Apply For These Two Philadelphia Tax Exemption Programs This Weekend

Finance Tax Office City Of Chester

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Leap Into Property Tax Savings Department Of Revenue City Of Philadelphia